There’s No Doubt About It, Early Detection Saves Lives Mainz Biomed N.V. (NASDAQ:MYNZ)

Mainz BioMed (NASDAQ:MYNZ) Could just have the answer to save countless lives WORLDWIDE

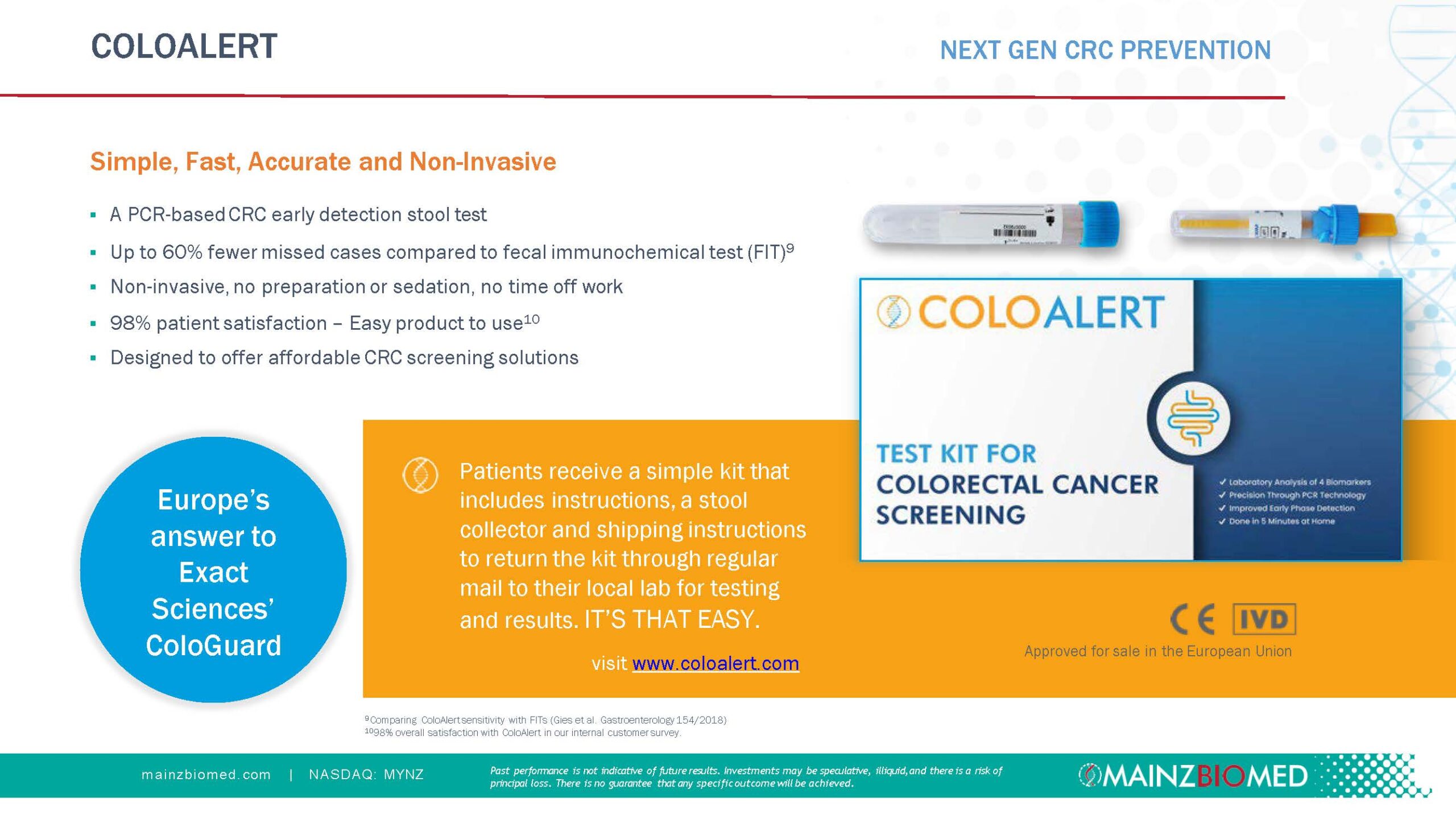

ColoAlert

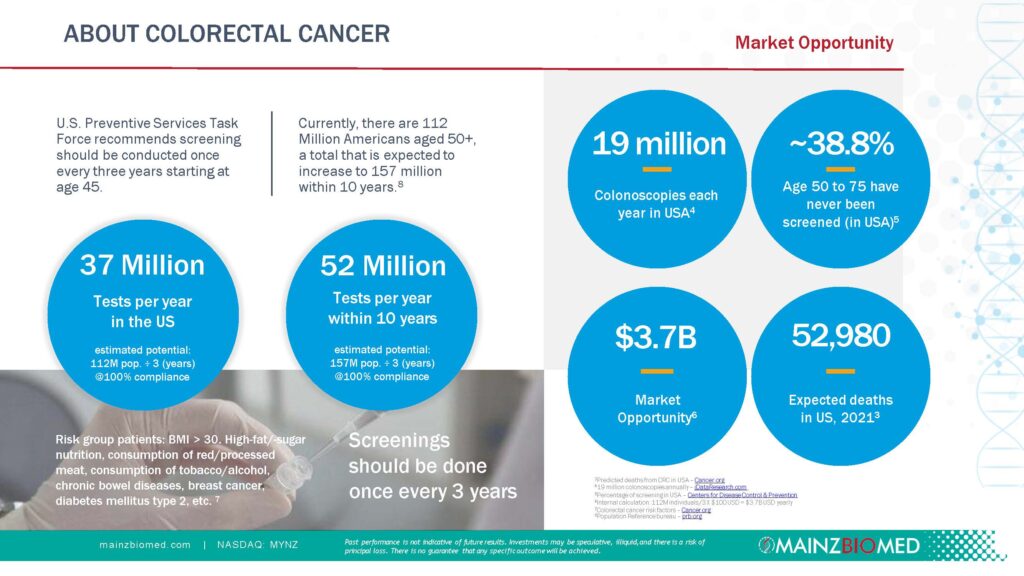

The Company’s Flagship Product (ColoAlert) Could Become An Inexpensive Alternative In A $3.7 Billion Market

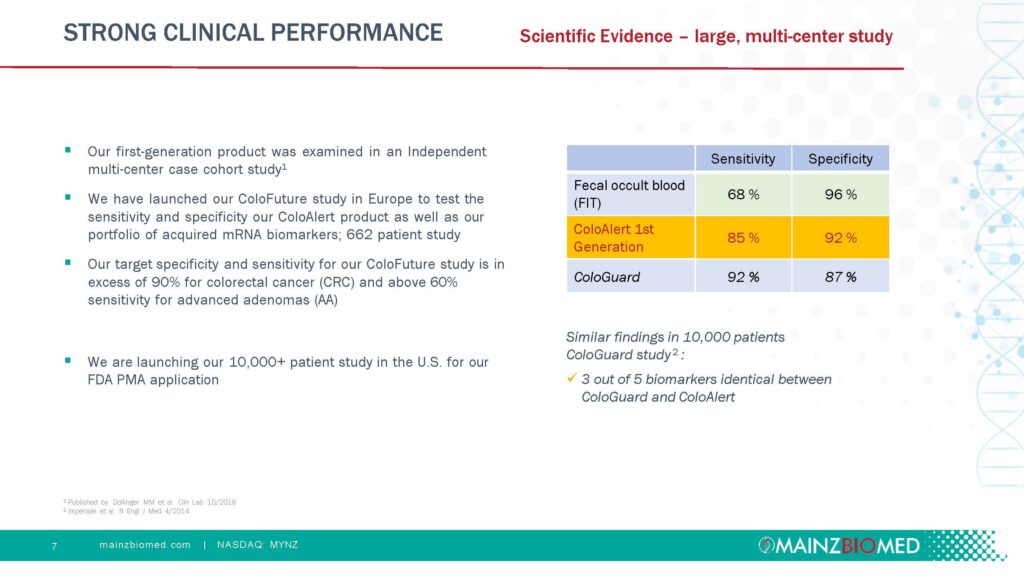

mRNA Biomarkers

The Company Recently Acquired Exclusive Rights To Novel mRNA Biomarkers (8)

FDA

If And When The Company Receives FDA Premarket Approval For Its ColoAlert Flagship Product, It Could Become A Game-Changing Milestone

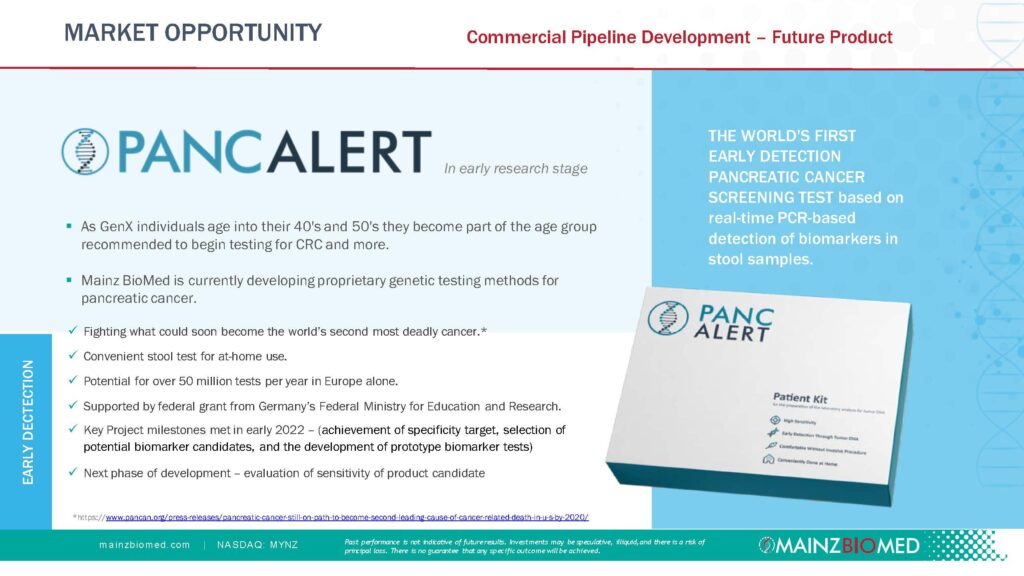

Pipeline

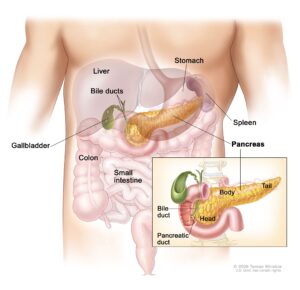

Another Key Pipeline Product Could Detect What May Become The World’s Second Most Deadly Cancer

Colorectal cancer is the 2nd most lethal cancer in the US, but also highly preventable; with early detection providing 5-year survival rates above 90%

Key Corporate & Product Development Highlights

- Accelerated international commercial activities for ColoAlert, the Company’s highly efficacious and easy-to-use detection test for colorectal cancer (CRC)

- Appointed Darin Leigh, former Abbott and Luminex executive, as Chief Commercial Officer

- Established partnership with Dante Labs to market ColoAlert in Italy and the United Arab Emirates

- Initiated and enrolled the first patient in an international clinical study (ColoFuture) evaluating the integration of novel mRNA biomarkers into ColoAlert – potentially upgrading its technical profile to achieve “gold standard” status for CRC at-home testing

- Received supportive feedback from the U.S. Food and Drug Administration (FDA) on ColoAlert’s pre-submission package for its U.S. pivotal clinical trial set to commence in Q4 2022

- Achieved multiple preclinical milestones supporting the continued development of PancAlert, a potential first-in-class screening test for pancreatic cancer

- Executed a $25.8 million (gross) public follow-on offering

- Expanded Strategic Advisory Board of global leaders in molecular diagnostic development and commercialization

Can you see why Mainz Biomed (Nasdaq: MYNZ) could be extremely undervalued at this moment?

Another Market Opportunity For Mainz Biomed ? You Better Believe It (1)

The Global Pancreatic Cancer Therapeutics Market Size is predicted to be worth USD 6,575 Million by 2030, with a CAGR of 7.2% from 2022 to 2030.

Great Opportunity - Trading Closer To Its 52-week Low With The Overall Market ROUT

BOARD OF DIRECTORS & ADVISORS

Time to Take Notice OF Mainz BioMed (NASDAQ:MYNZ)

Disclaimer:This website / media webpage is owned, operated and edited by Investor Brand Media. Any wording found on this website / media webpage or disclaimer referencing to “I” or “we” or “our” or “IBM” refers to Investor Brand Media. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. Our business model is to be financially compensated to market and promote small public companies. By reading our website / media webpage you agree to the terms of our disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature and are therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment purposes only. At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. By using our service you agree not to hold our site, its editor’s, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within our website / media webpage.We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Our website / media webpage are for entertainment purposes only. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data. This publication and their owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. IBM business model is to receive financial compensation to promote public companies. To conduct investor relations advertising, marketing and publicly disseminate information not limited to our Websites, Email, SMS, Push Notifications, Influencers, Social Media Postings, Ticker Tags, Press Releases, Online Interviews, Podcasts, Videos, Audio Ads, Banner Ads, Native Ads, Responsive Ads. This compensation is a major conflict of interest in our ability to be unbiased regarding. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the hiring third party or parties. The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts. Frequently companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, IBM often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. The information in our disclaimers is subject to change at any time without notice. Investor Brand Media has been compensated four thousand two hundred and fifty dollars by a 3rd party Bullyzeye Media LLC for content, research, dissemination, and syndication, web push advertisement services pertaining to MYNZ.

References: https://www.acumenresearchandconsulting.com/pancreatic-cancer-therapeutics-market

https://finance.yahoo.com/news/mainz-biomed-appoints-dr-douglas-070100627.html

https://finance.yahoo.com/news/mainz-biomed-reports-first-half-070100420.html

https://mainzbiomed.com/wpcontent/uploads/2021/07/Mainz-BioMed-Corporate-Update-January-2022-v1.13.21-1.pdf

https://www.cancer.org/cancer/colon-rectal-cancer/about/key-statistics.html

Investors