ASML Holding NV (NASDAQ:ASML) is a Dutch company that specializes in manufacturing and selling photolithography systems for the semiconductor industry. The company is a crucial player in the industry and is known for its cutting-edge technology, which has made it a valuable partner for major chip manufacturers worldwide.

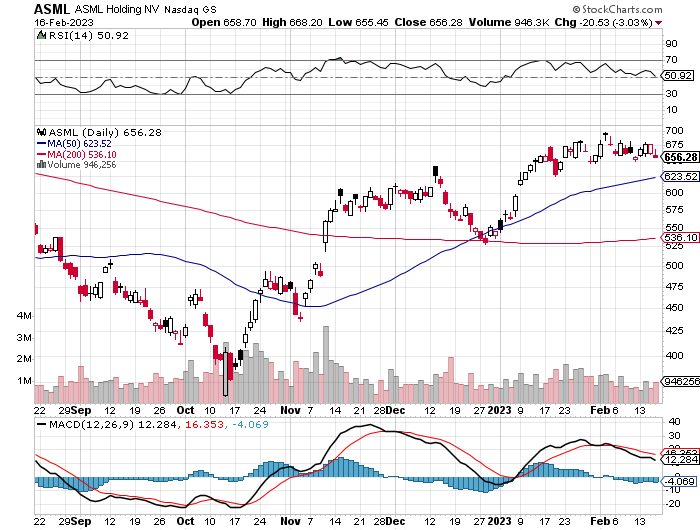

ASML traded at $656.28, down $20.53 (-3.03%).

ASML was founded in 1984 and was initially a joint venture between Philips and Advanced Semiconductor Materials International (ASMI). The company has since grown to become the world’s largest supplier of photolithography systems for the semiconductor industry, with a market share of over 80%.

Photolithography is a key process in semiconductor manufacturing, which involves the transfer of a pattern onto a silicon wafer. This process is critical in the production of integrated circuits, microprocessors, and other electronic components. ASML’s photolithography systems are used to create chips with ever-shrinking feature sizes, enabling the development of faster and more powerful electronic devices.

ASML’s success can be attributed to its relentless focus on innovation and technology. The company invests heavily in research and development and has a team of over 27,000 employees worldwide, including 6,000 researchers and developers. This has allowed the company to continuously push the boundaries of photolithography technology, making it possible to manufacture chips with ever-smaller feature sizes.

ASML’s photolithography systems use a technique called Extreme Ultraviolet (EUV) lithography, which is capable of producing much smaller feature sizes than previous techniques. This technology uses a light source that emits ultraviolet light with a wavelength of just 13.5 nanometers, which is 20 times shorter than the wavelength used in previous photolithography systems. This enables the production of chips with feature sizes as small as 5 nanometers.

ASML’s EUV technology is a significant breakthrough for the semiconductor industry. It has made it possible to produce more powerful chips while reducing the size and power consumption of electronic devices. This technology has also opened up new possibilities for the development of artificial intelligence, autonomous vehicles, and other cutting-edge technologies that require powerful chips with small form factors.

ASML’s technology is in high demand from major chip manufacturers worldwide, including Intel, Samsung, and TSMC. The company’s photolithography systems are expensive, with a single system costing over $100 million. However, the high cost is justified by the value of the technology and the critical role it plays in the semiconductor industry.

ASML’s success has made it a valuable partner for governments worldwide, with the Dutch government owning a 5% stake in the company. The Dutch government has also provided significant support to the company, including tax incentives and research grants.

ASML is also committed to sustainability and reducing its environmental impact. The company has set ambitious goals to reduce its carbon footprint, including achieving carbon neutrality by 2040. The company is also investing in renewable energy and reducing the energy consumption of its photolithography systems.

In conclusion, ASML is a crucial player in the semiconductor industry and a leader in photolithography technology. The company’s focus on innovation and technology has enabled it to continuously push the boundaries of photolithography, making it possible to produce ever-smaller chips with more powerful features. ASML’s EUV technology is a significant breakthrough for the semiconductor industry, and its photolithography systems are in high demand from major chip manufacturers worldwide. The company’s commitment to sustainability and reducing its environmental impact is also commendable, and its success has made it a valuable partner for governments and other stakeholders worldwide.

Other companies in ASML Holding’s space includes: Teradyne (NASDAQ:TER), Applied Mat (NASDAQ:AMAT), Enphase Energy (NASDAQ:ENPH), Ichor Hldgs (NASDAQ:ICHR) and Amkor Technology (NASDAQ:AMKR).