Lithium, the elemental metal, is a hot commodity these days. Since it is used in the manufacture of batteries, increasing electric vehicle (EV) sales have many investors feeling optimistic about companies that produce the basic element. Although lithium is a common substance, prices for the material skyrocketed some 400% in 2021 and have continued to rise so far in 2022 — easily exceeding previous all-time highs reached in 2017 (1)

In the U.S., the Infrastructure Investment and Jobs Act set aside $5 billion in federal funding for EV charging stations to support President Biden’s goal of getting EVs to account for 50 percent of new auto sales by 2030. With automakers on board, there will be ample demand for lithium in the years ahead and that bring lithium mining stocks in focus.

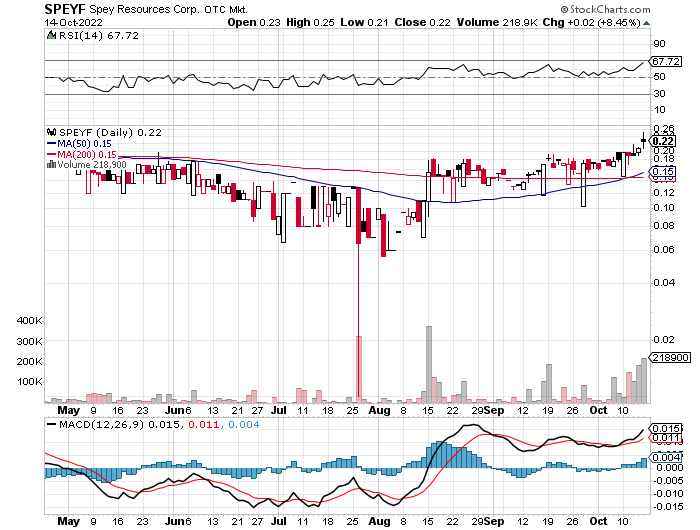

One micro/nano company that we would like to draw your attention to is Spey Resources Corp. (CSE: SPEY) (OTC: SPEYF) (FRA: 2JS). Spey Resources (SPEYF) is a Canadian lithium focused mineral exploration company which holds two option agreements to acquire 100% interest in the Candela II, Pocitos I and II lithium brine projects located in the Salta Province, Argentina. Spey also owns 100% of the mineral rights to 4 lithium exploration projects located in the James Bay Region of Quebec, in proximity to a recent hard rock lithium discovery. Spey also holds an option to acquire a 100% undivided interest in the Silver Basin Project located in the Revelstoke Mining Division of British Columbia as well as an option to acquire a 100% interest in the Kaslo Silver project, west of Kaslo, British Columbia.

Will this mining company gain attention from Wall Street?

Spey Resources Corp (SPEYF) announced that it has completed the acquisition of 100% of the issued and outstanding share capital of Lithium Energy Metal Corporation (“LEM”) from all of the former shareholders of LEM. In consideration for the Acquisition, the Company issued an aggregate 8,900,000 common shares in the capital of the Company (each, a “Spey Share”) to the LEM Shareholders (collectively). The Company has also issued 890,000 Spey Shares as a finder’s fee to an arm’s length finder in connection with the Acquisition (3). LEM holds interests in four projects in the James Bay Region of Quebec near projects held by Patriot Battery Metals Inc. The projects vary in distance from PMET’s projects, one of them being within approximately one kilometer of the border of a PMET project.

- The 454 Block Project – consists of 10 contiguous claims (513 hectares). The claims occur within the Archean Langelier Complex, which are the oldest rocks in the Le Grand sub-province of the regional Superior Province, and comprise foliated tonalite with hornlende-biotite magnetite.

- The West Lac Corvette Project – consists of 10 contiguous claims (513 hectares). The claims cover Mesoarchean rocks of the Rouget Formation, derived from basalts as well as Neoarchean Marbot Formation wackes (with injections of granite), and southern margin of the Mesoarchean tonalite pluton (post de Le Moyne).

- The Trieste Project – consists of two separate contiguous blocks totaling 50 claims and covering 2,575 hectares (618 hectares north, and 1,957 hectares south), with mylonite and amphibolite rocks of the Mesoarchean Trieste Formation that were derived from basalts.

- Salomon Project – 100 claims in two separate continuous blocks, covering 5,155 hectares. The project includes Mesoarchean mylonites and amphibolites, as well as younger Neoarchean metamorphic wackes and arkoses.

If all of SPEYFs mining projects come to fruition, we could very well see a potential increased interest from Wall Street. Key is to stay ahead of the crowd. For more information, please visit https://www.speyresources.ca/.

Some of the other lithium stocks to keep on radar are Albemarle Corporation (NYSE:ALB), Ganfeng Lithium Ord Shs H (OTCMKTS: GNENF), Sociedad Química y Minera de Chile (SQM), Lithium Americas Corporation (LAC), Piedmont Lithium Limited (PLL), Livent Corporation (LTHM). Further, some of the lithium ETFs to consider would be Global X Lithium & Battery Tech ETF (LIT), Amplify Lithium & Battery Technology ETF (BATT), VanEck Vectors Rare Earth/Strategic Metals ETF (REMX) (2). A list of EV stocks to keep an eye out are Phoenix Motor (NASDAQ:PEV), XPeng (NYSE:XPEV), Fisker (NYSE:FSR), General Motors (NYSE:GM) and Ford Motor (NYSE:F), Phoenix Motor (NASDAQ:PEV), Fisker (NYSE:FSR), General Motors (NYSE:GM).

Sources:

1. https://www.fool.com/investing/stock-market/market-sectors/materials/metal-stocks/lithium-stocks/

2. https://www.forbes.com/advisor/investing/best-lithium-stocks/

3. https://finance.yahoo.com/news/spey-resources-corp-completes-acquisition-120000523.html

Clicks to read more about the hot stocks for the day.

Disclaimer: InvestorBrandMedia is not operated by a licensed broker, a dealer, or a registered investment adviser. It should be expressly understood that under no circumstances does any information published herein represent a recommendation to buy or sell a security. Our reports/releases are commercial advertisements and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The information made available in this article is not intended to be, nor does it constitute investment advice or recommendations. The contributors may buy and sell securities before and after any particular article, report, and publication. In no event shall InvestorBrandMedia be liable to any member, guest, or third party for any damages of any kind arising out of the use of any content or other material published or made available by InvestorBrandMedia ., including, without limitation, any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages. Past performance is a poor indicator of future performance. The information in this video, article, and in its related newsletters, is not intended to be, nor does it constitute investment advice or recommendations. InvestorBrandMedia.com strongly urges you to conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D. For some content, Investor Brand Media, its authors, contributors, or its agents, may be compensated for preparing research, video graphics, and editorial content. As part of that content, readers, subscribers, and website viewers are expected to read the full disclaimers and financial disclosures statement that can be found on our website by visiting InvestorBrandMedia.com/Disclaimer. The Private Securities Litigation Reform Act of 1995 provides investors a safe harbor in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions, or future events or performance are not statements of historical fact may be forward-looking statements. Forward-looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties, which could cause actual results or events to differ materially from those presently anticipated. Forward-looking statements in this action may be identified through the use of words such as projects, foresee, expects, will, anticipates, estimates, believes, understands, or that by statements indicating certain actions & quotes; may, could, or might occur. Understand there is no guarantee past performance will be indicative of future results. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investor’s investment may be lost or impaired due to the speculative nature of the companies profiled. InvestorBrandMedia has been compensated one thousand dollars by a 3rd party Bullyzeye Media LLC for content, research, dissemination, and syndication pertaining to SPEYF for 10/12/2022 and 10/18/2022 dates. We own zero shares of SPEYF.